New York State Paid Family Leave

Paid leave for eligible non-academic staff members to bond with a new child, care for a family member with a serious health condition, or for a qualifying military exigency.

Explanation of Paid Family Leave benefit

Paid Family Leave offers eligible employees job-protected, paid time off for the following reasons:

- Bonding with a newly born, adopted, or fostered child

- Caring for a family member with a serious health condition

- Assisting loved ones when a spouse, domestic partner, child, or parent is deployed abroad on active military service

In some cases, Paid Family Leave may also be available if an employee or their minor dependent child is under an order of quarantine or isolation due to COVID-19.

Paid Family Leave provides up to 12 weeks (which can be taken all at once or on an intermittent basis) of job-protected time off at 67 percent of your average weekly wage.

Eligibility and deductions

- Non-academic staff who work 20 or more hours per week are eligible to request the leave after 26 weeks of employment.

- Non-academic staff who work less than 20 hours per week are eligible to request the leave after 175 days worked (not consecutive days employed).

New York State specified that the Paid Family Leave Program is employee-funded, and that employers shall collect an employee contribution through a payroll deduction determined annually by the New York State Department of Financial Services.

- For 2025: The payroll deduction rate for 2025 has been lowered to .388%, with a maximum annual cap of $354.53 . That means if the deduction rate of .388% results in an employee contributing $354.53 in PFL premiums, then Cornell will automatically cease taking further premiums for the remainder of the calendar year.

All items on this form must be completed and submitted at least 30 days in advance of the requested leave. If less than 30 days advance notice is being given, an explanation must be provided. Additional forms and supporting documentation will be required depending on the type of leave being requested. These forms will be provided once the PFL Request Form has been received.

Note: Employees working outside New York State:

Employees working in other states with state-provided paid family and/or medical leave benefits will be covered under the terms of their respective state's policies. If you are unsure whether your state provides its own paid family or medical leave benefit you may contact Medical Leaves Administration (MLA) at 607-255-1177, and MLA can direct you to the appropriate state agency which would receive your request for paid leave.

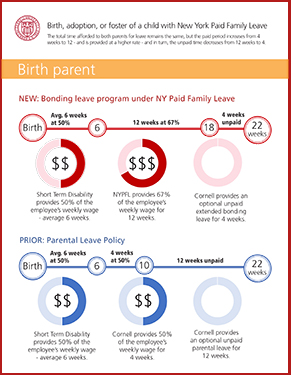

Bonding Leave: Birth, adoption, or foster of a child with New York Paid Family Leave

The total time afforded to both parents for leave remains the same, but the paid period increases from 4 weeks to 12 - and is provided at a higher rate - and in turn, the unpaid time decreases from 12 weeks to 4.

Check out our comparison graphic to see how the new bonding leave program under NYPFL matches up to the prior parental leave policy.

Faculty and academics

See University Policy 6.2.1, Leaves for Professors and Academic Staff.